43 ytm zero coupon bond

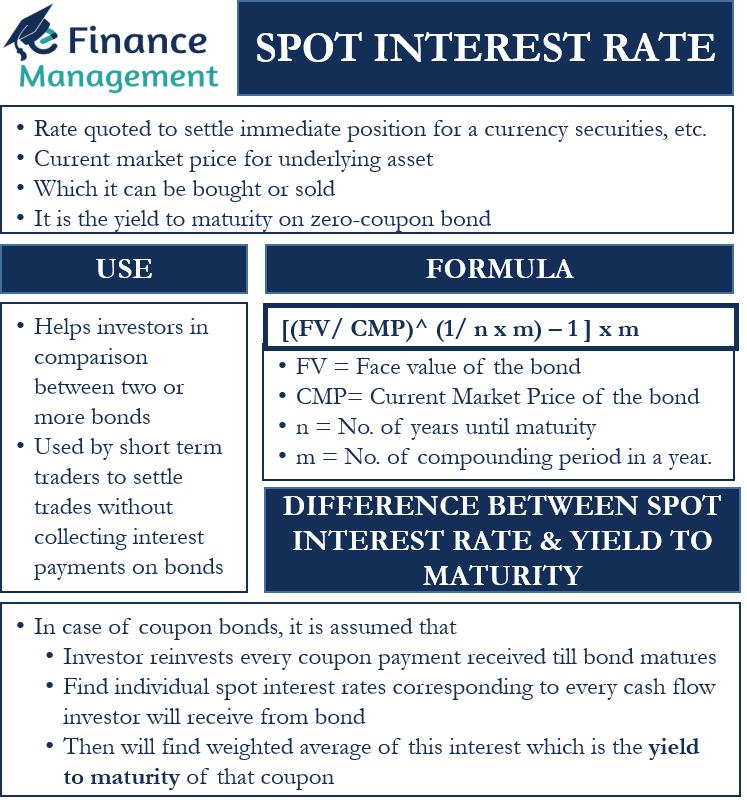

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Interest Rate Statistics | U.S. Department of the Treasury WebNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market …

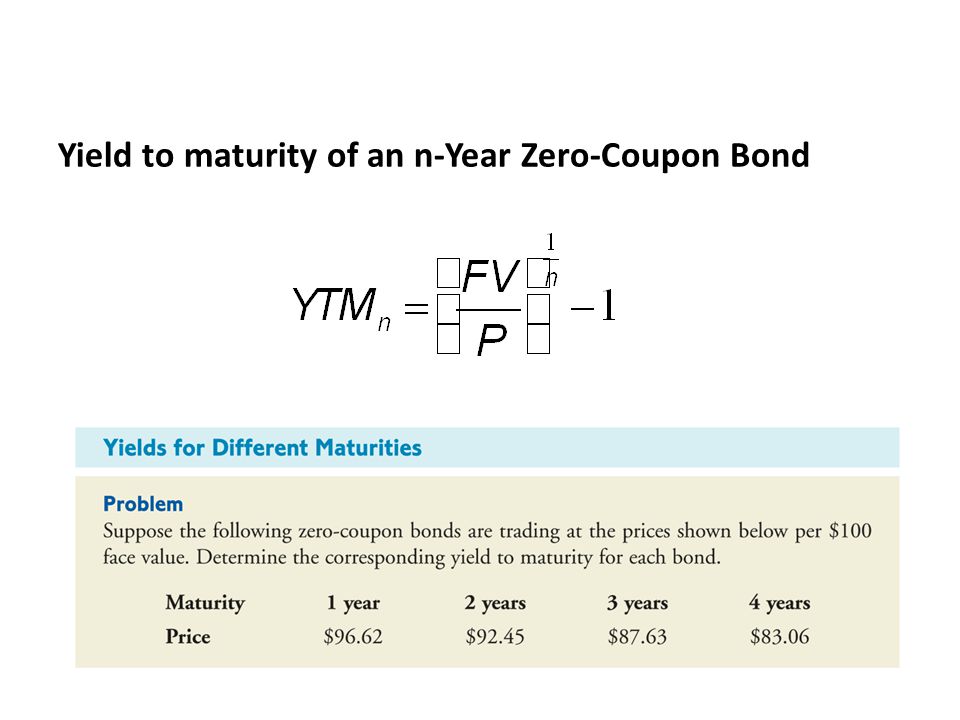

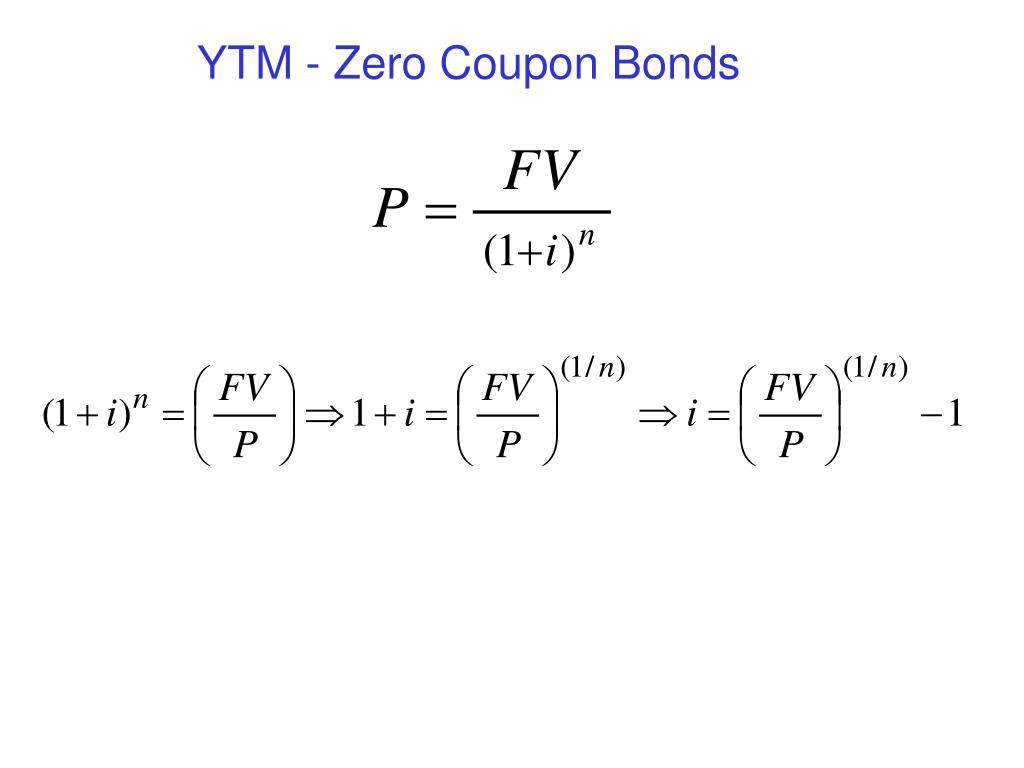

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value.

Ytm zero coupon bond

Calculate the YTM of a Zero Coupon Bond - YouTube Calculate the YTM of a Zero Coupon Bond 4,185 views Jul 26, 2018 20 Dislike Share Michael Padhi 627 subscribers This video explains how to calculate the yield to maturity (YTM) of a zero... Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ WebP: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr Abhishek ... #zerocouponbond #deepdiscountbond #howtocalculateyieldondeepdiscountbond for video of zero coupon bond click here for video of bond & debentures - introduction...

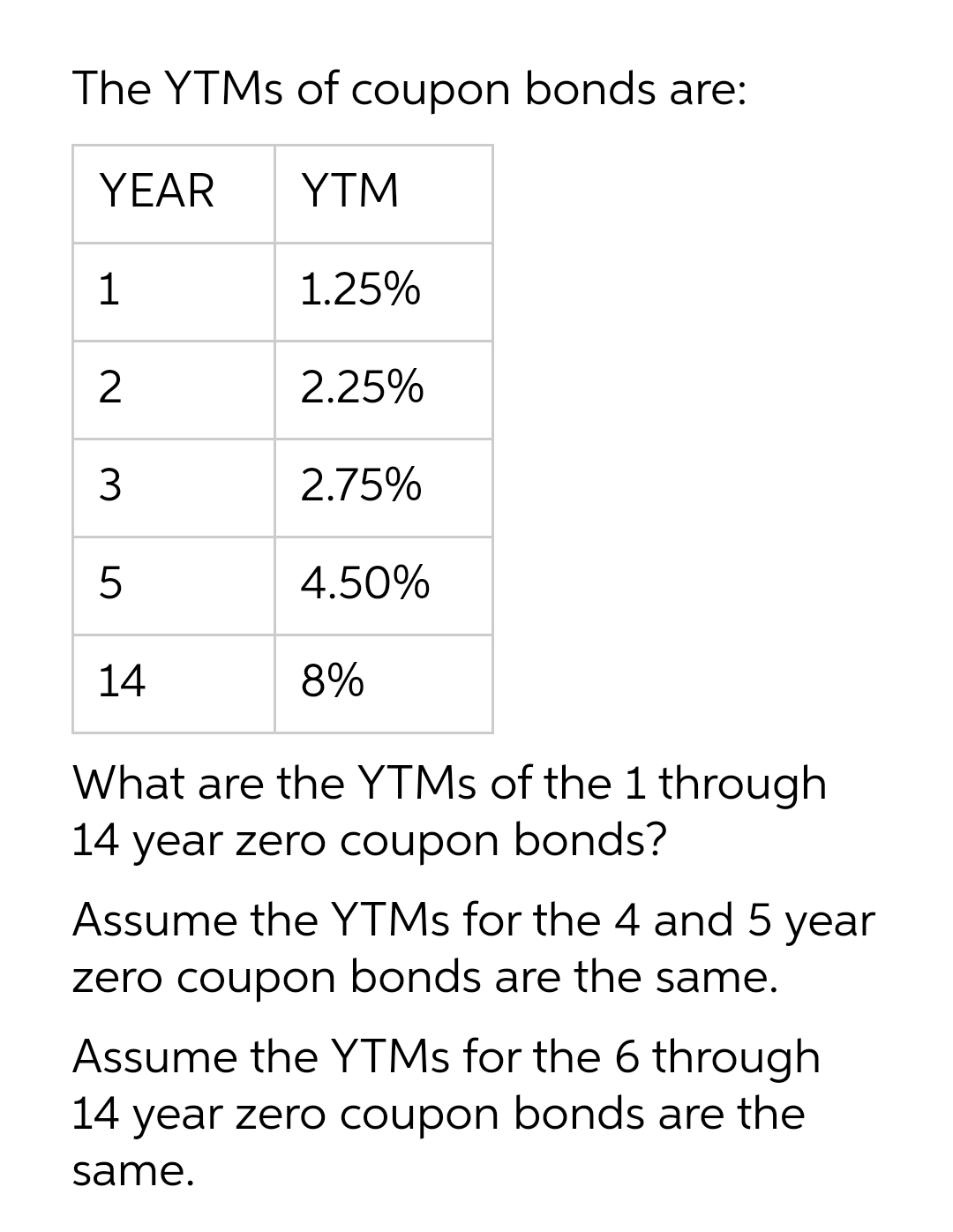

Ytm zero coupon bond. Yield to Maturity (YTM): What It Is, Why It Matters, Formula Web31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. How to Calculate the Price of Coupon Bond? - WallStreetMojo Web= $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). …

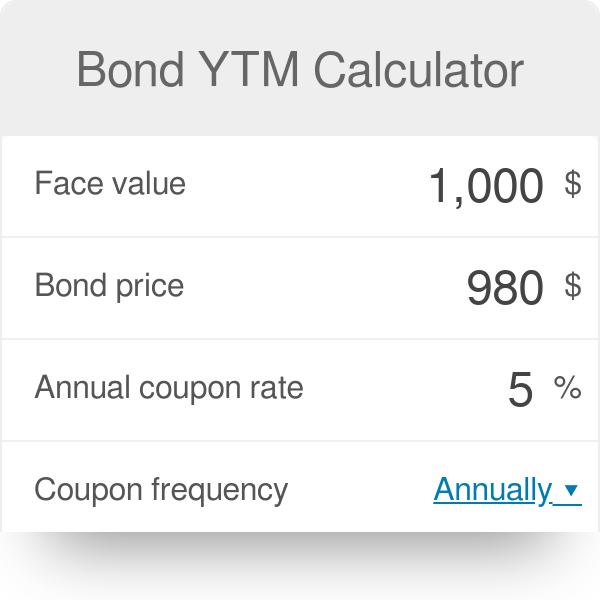

Bond Yield to Maturity (YTM) Calculator - DQYDJ WebYou can compare YTM between various debt issues to see which ones would perform best. Note the caveat that YTM though – these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an... 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund … Web30.09.2022 · Yield to Maturity (YTM) is the estimated total return of a bond if held to maturity. YTM accounts for the present value of a bond’s future coupon payments. PIMCO calculates a Fund's Estimated YTM by averaging the YTM of each security held in the Fund on a market-weighted basis. PIMCO pulls each security's YTM from PIMCO's Portfolio … Current Yield vs. Yield to Maturity - Investopedia Web12.10.2022 · Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. ytmZeroCouponBond: Calculates the Yield-To-Maturity(YTM) of a Zero ... The method ytmZeroCouponBond () is developed to compute the Yield-To-Maturity a Zero-Coupon Bond. So, ytmZeroCouponBond () gives the Price of a Zero-Coupon Bond for values passed to its three arguments. Here, maturityVal represents the Maturity Value of the Bond, n is number of years till maturity, and price is Market Price of Zero-Coupon Bond. › knowledge › zero-coupon-bondZero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity. The n is the number of years from now until the bond matures.

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. The zero coupon bond formula is as follows:

› investing › how-to-investHow to Invest in Bonds | The Motley Fool Nov 24, 2022 · For example, you might buy a 10-year, $10,000 bond paying 3% interest. In exchange, your town will promise to pay you interest on that $10,000 every six months and then return your $10,000 after ...

Return of zero coupon bond in Excel. YTM of zero coupon bond with Excel ... Learn how to calculate yield to maturity (YTM) of a zero coupon bond with excel. @RK varsity

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … WebCalculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical bonds a …

Yield to Maturity (YTM): Formula and Bond Calculation - Wall … WebStep 3. Semi-Annual Coupon Payment on Bond Calculation. As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to arrive at the semi-annual coupon of the bond. Step 4. Yield to Maturity Calculation Example. With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM).

Consider a coupon bond that has a 900 par value and a coupon rate of 6 %. The bond is currently selling for 860.15 and has two years to maturity. What is the bond's yield to maturity (YTM)?

Zero Coupon Bond Calculator - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term.

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Web10.10.2022 · Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity . The bond is currently valued at $925, the price at which it could be purchased today.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ...

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr Abhishek ... #zerocouponbond #deepdiscountbond #howtocalculateyieldondeepdiscountbond for video of zero coupon bond click here for video of bond & debentures - introduction...

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ WebP: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Calculate the YTM of a Zero Coupon Bond - YouTube Calculate the YTM of a Zero Coupon Bond 4,185 views Jul 26, 2018 20 Dislike Share Michael Padhi 627 subscribers This video explains how to calculate the yield to maturity (YTM) of a zero...

![PDF] Yield-to-Maturity and the Reinvestment of Coupon ...](https://d3i71xaburhd42.cloudfront.net/cd78b917effc5ad37eadf3dd6629e42e1a6f88f3/2-Figure1-1.png)

Post a Comment for "43 ytm zero coupon bond"