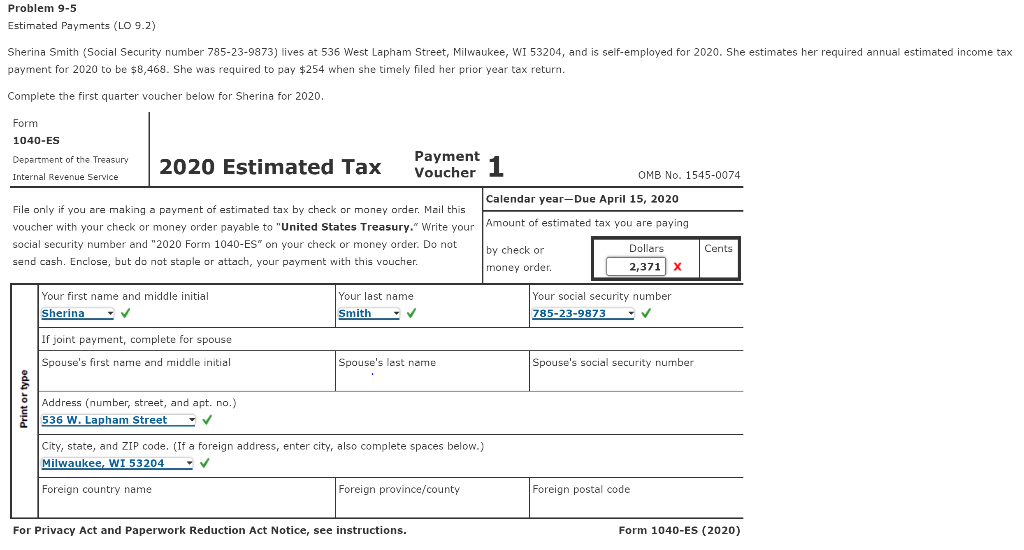

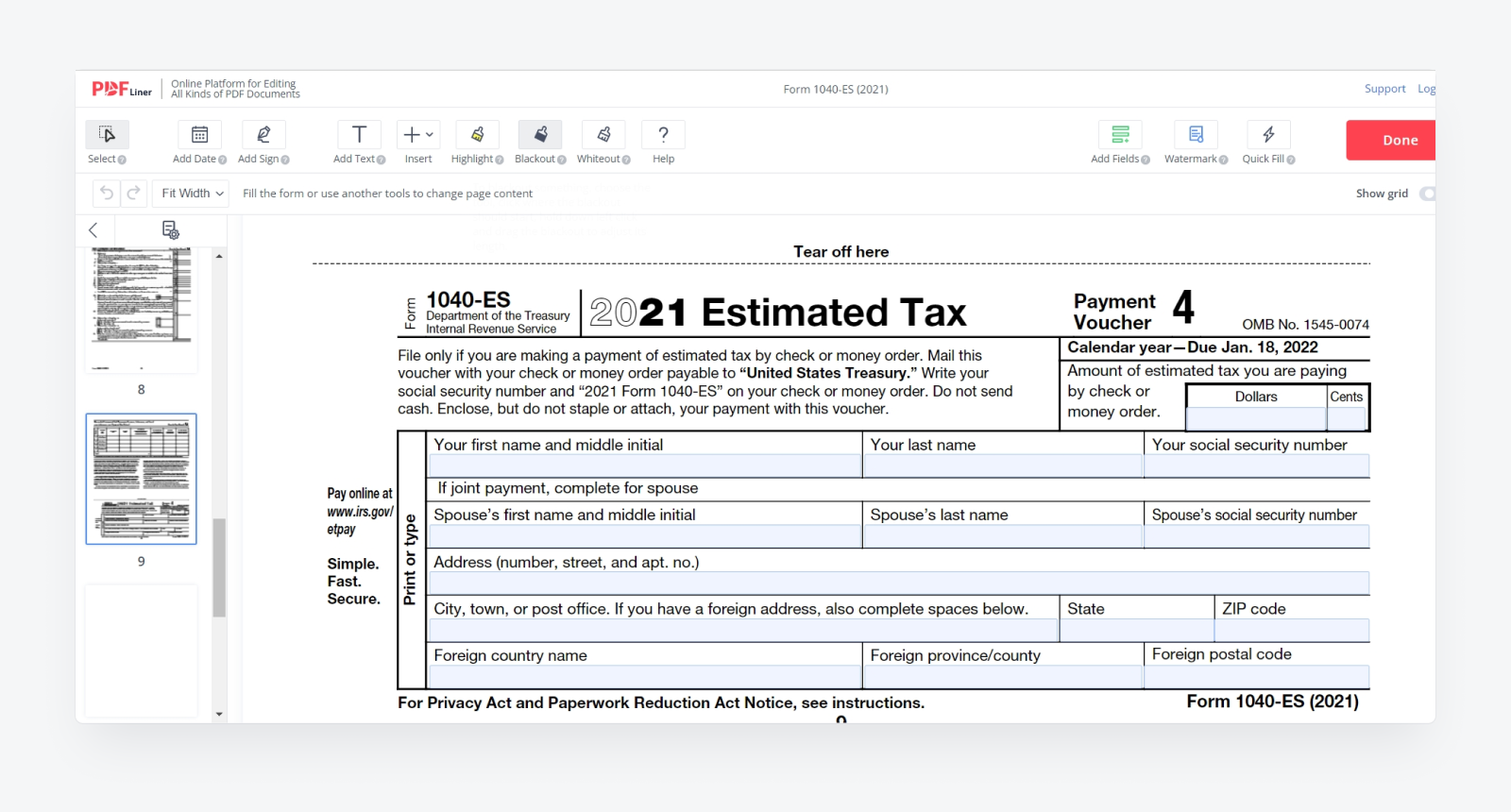

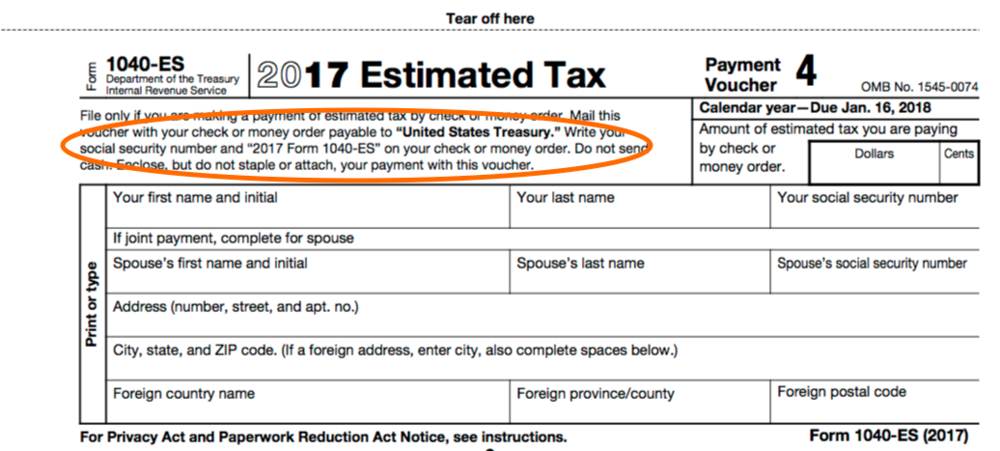

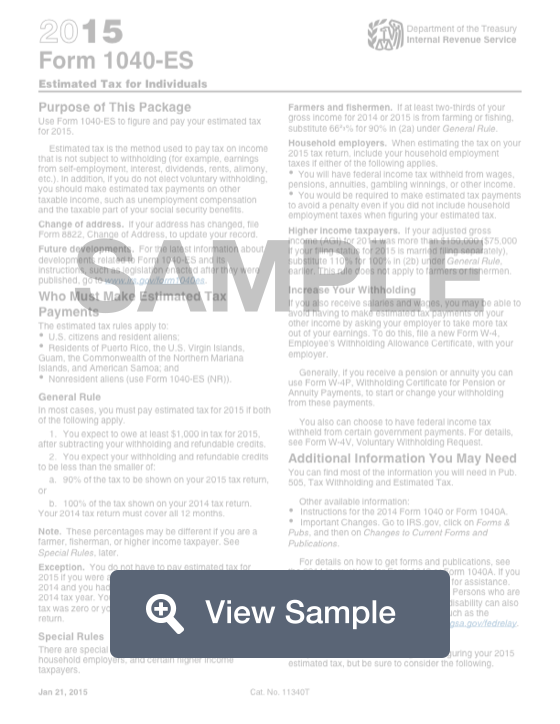

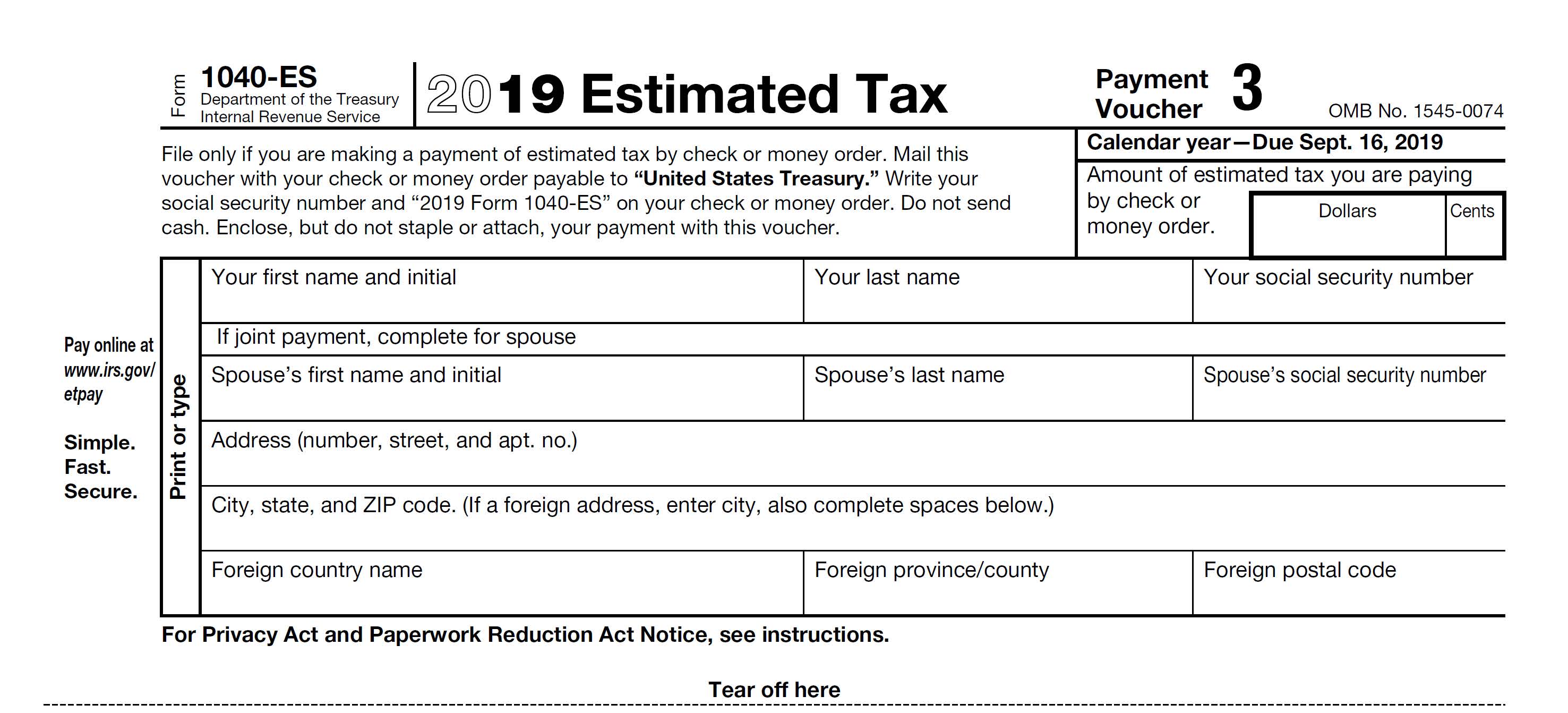

39 irs quarterly payment coupon

Publication 523 (2021), Selling Your Home - IRS tax forms Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 17 (2021), Your Federal Income Tax | Internal ... See payment plan details or apply for a new payment plan. Make a payment, view 5 years of payment history and any pending or scheduled payments. Access your tax records, including key data from your most recent tax return, your economic impact payment amounts, and transcripts. View digital copies of select notices from the IRS.

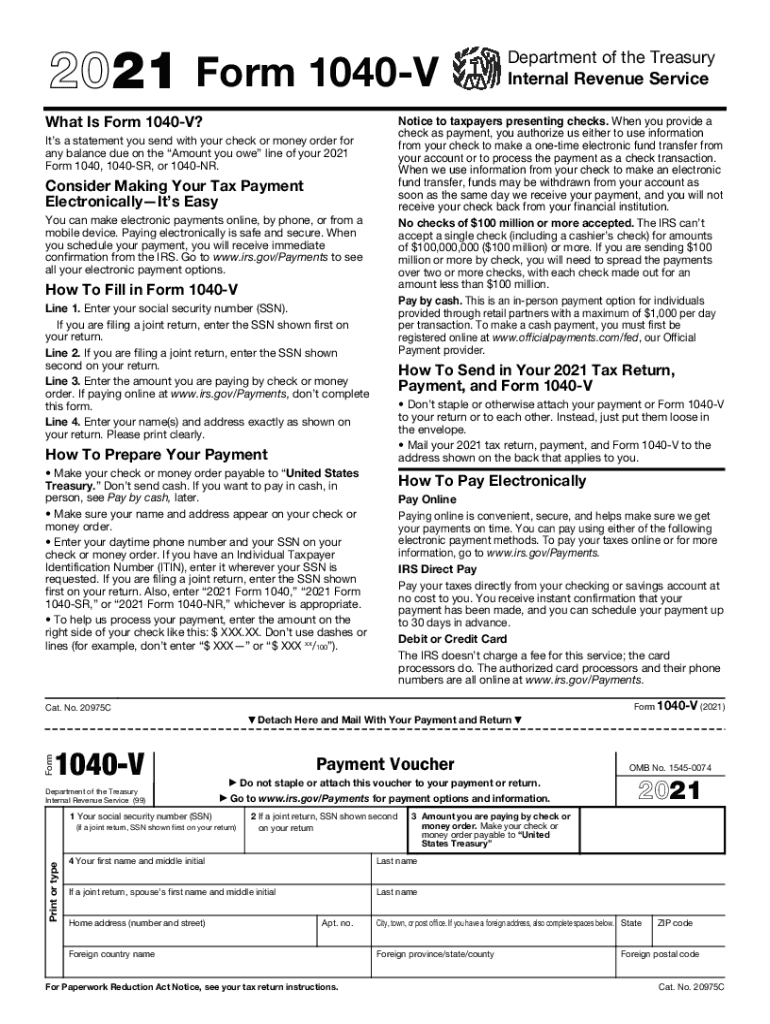

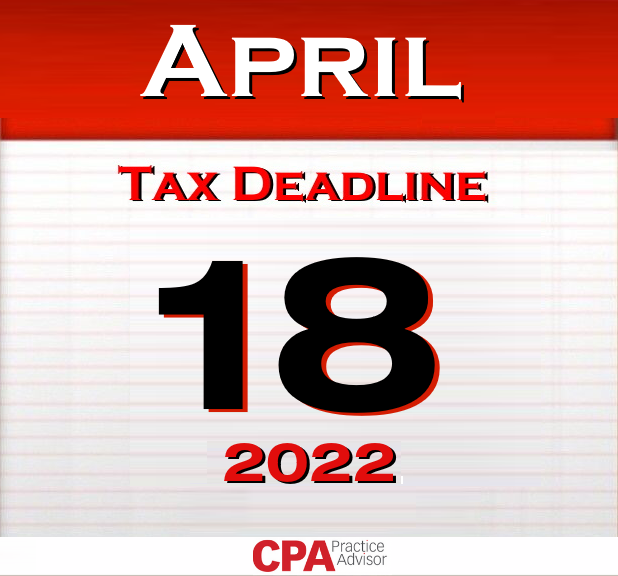

Payments | Internal Revenue Service - IRS tax forms Oct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

Irs quarterly payment coupon

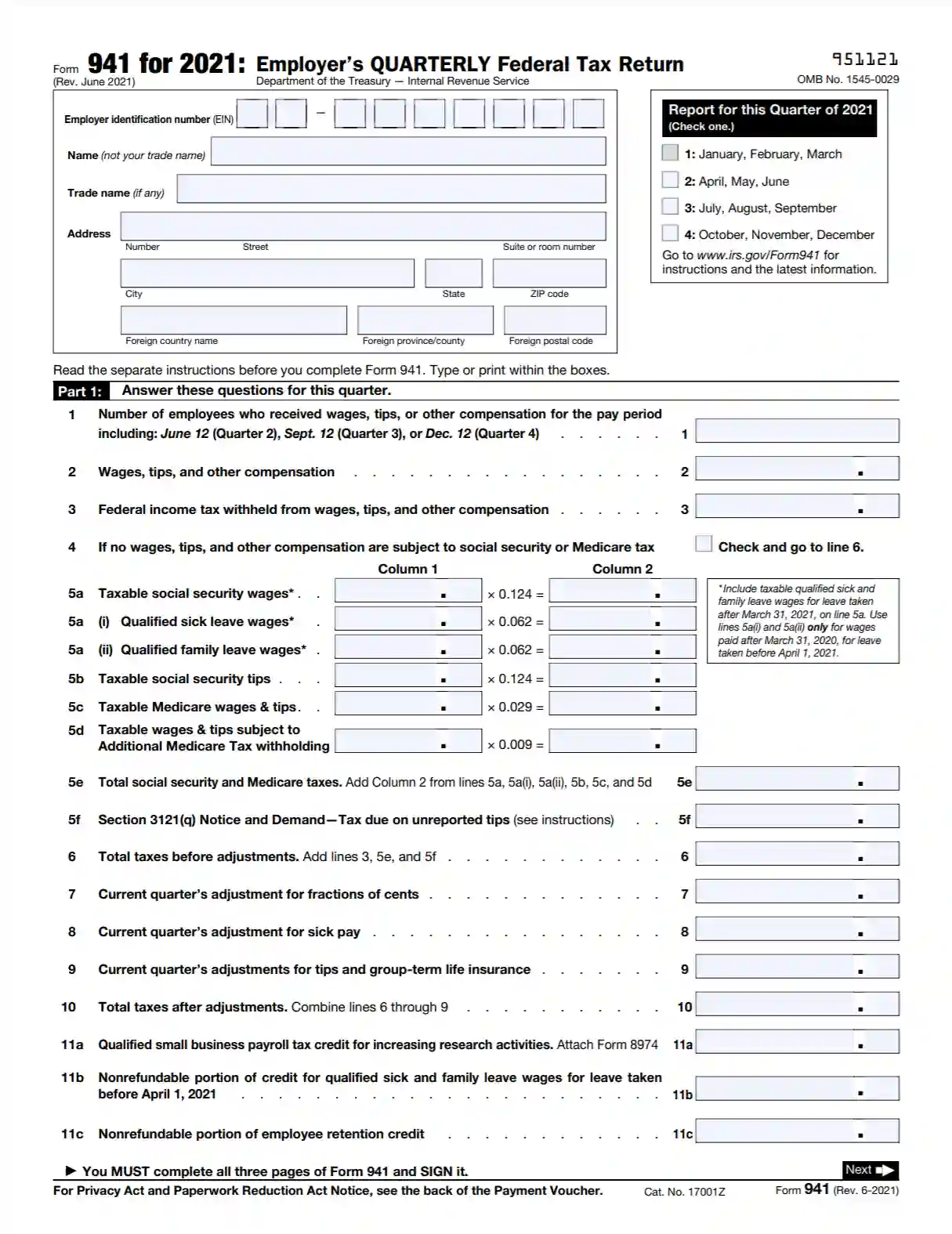

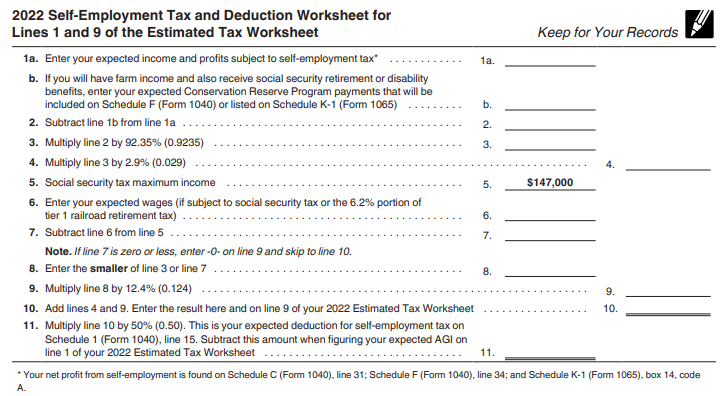

Publication 15-A (2022), Employer's Supplemental Tax Guide 2022 withholding tables. The discussion on the alternative methods for figuring federal income tax withholding and the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members are no longer included in Pub.15-A. This information is now included in Pub. 15-T What Is the Minimum Monthly Payment for an IRS Installment ... Nov 17, 2022 · Fees for IRS installment plans. If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465. Instructions for Forms 1099-INT and 1099-OID (01/2022 ... Exempt recipients. You are not required to file Form 1099-INT for payments made to certain payees including, but not limited to, a corporation, a tax-exempt organization, any individual retirement arrangement (IRA), Archer medical savings account (MSA), Medicare Advantage MSA, health savings account (HSA), a U.S. agency, a state, the District of Columbia, a U.S. possession, a registered ...

Irs quarterly payment coupon. Publication 1212 (01/2022), Guide to Original Issue Discount ... For a stripped bond or coupon acquired after 1984, and before April 4, 1994, an accrual period is each 6-month period that ends on the day that corresponds to the stated maturity date of the stripped bond (or payment date of a stripped coupon) or the date 6 months before that date. Instructions for Forms 1099-INT and 1099-OID (01/2022 ... Exempt recipients. You are not required to file Form 1099-INT for payments made to certain payees including, but not limited to, a corporation, a tax-exempt organization, any individual retirement arrangement (IRA), Archer medical savings account (MSA), Medicare Advantage MSA, health savings account (HSA), a U.S. agency, a state, the District of Columbia, a U.S. possession, a registered ... What Is the Minimum Monthly Payment for an IRS Installment ... Nov 17, 2022 · Fees for IRS installment plans. If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465. Publication 15-A (2022), Employer's Supplemental Tax Guide 2022 withholding tables. The discussion on the alternative methods for figuring federal income tax withholding and the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members are no longer included in Pub.15-A. This information is now included in Pub. 15-T

:max_bytes(150000):strip_icc()/466666219-F-56a492cd3df78cf772830a5c.jpg)

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "39 irs quarterly payment coupon"