41 us treasury coupon rate

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Monthly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2003-2007 TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2008-2012 TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present United States Government Bond 10Y - 2022 Data - 1912-2021 Historical ... The US 10-year Treasury note yield hit 3.9% for the first time since April 2010 as expectations of higher interest rates to rein on sky-high inflation continued to dent appetite for government debt.

2 Year Treasury Rate - YCharts The 2 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy. Historically, the 2 year treasury yield went as low as 0.16% in the low rate environment after the Great Recession. 2 Year Treasury Rate is at 4.20%, compared to 4.11% the previous market day and 0.27% last year.

Us treasury coupon rate

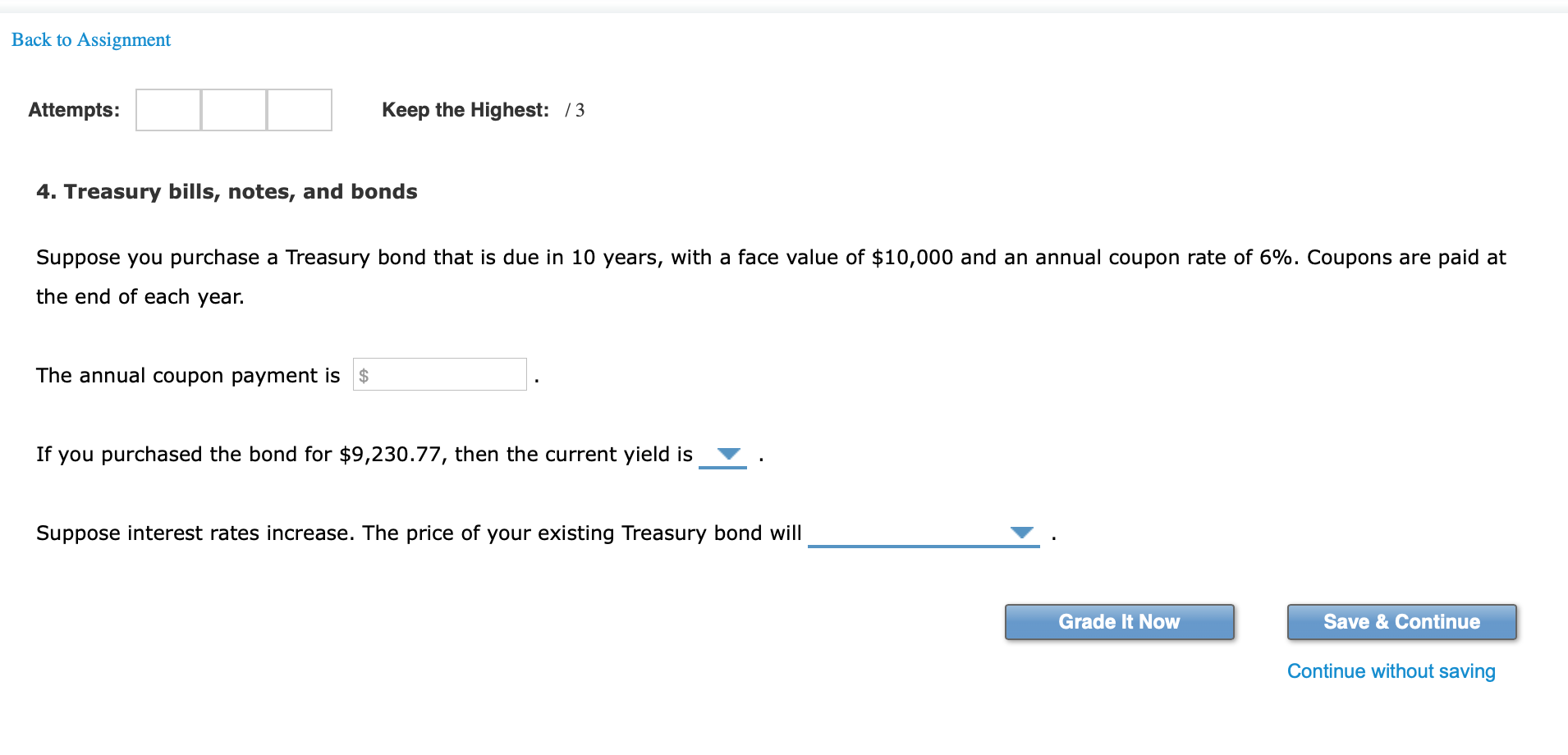

Individual - Treasury Bonds: Rates & Terms Interest Coupon Rate Price Explanation; Discount (price below par) 30-year bond Issue Date: 8/15/2005: 4.35%: 4.25%: 98.333317: Below par price required to equate to 4.35% yield: Premium (price above par) 30-year bond reopening Issue Date: 9/15/2005: 3.99%: 4.25%: 104.511963: Above par price required to equate to 3.99% yield What Is a Treasury Note? How Treasury Notes Work for Beginners What Do Treasury Notes Pay? Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields Treasury bonds, bills, and notes will all have varying yields. Longer-term Treasury securities typically yield higher returns than shorter-term Treasury securities. Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

Us treasury coupon rate. Treasury Bill Rates - NASDAQ - Datastore Treasury Bill Rates. From the data product: US Treasury (12 datasets) Refreshed a day ago, on 24 Sep 2022 ... The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year. The Coupon Equivalent can be used to compare the yield on a discount ... Government - Continued Treasury Zero Coupon Spot Rates* Treasury Spot Rates, Office of Thrift Supervision (OTS) Method; End of Quarter, Percent; Maturity 2012 2013; Years Months I II III IV I II; 0.5: 6: 0.15: 0.16: 0.14: 0.11: 0.11: 0.10: 1: 12: 0.19: 0.21: 0.17: 0.16: 0.14: 0.15: 2: 24: 0.33: 0.33: 0.23: 0.25: 0.25: 0.36: 3: 36: 0.51: 0.41: 0.31: 0.36: 0.36: 0.66: 4: 48: 0.78: 0.56: 0.47: 0.54: 0.56: 1.04: 5: 60: 1.05: 0.72: 0.62: 0.72: 0.78: 1.43: 6: 72: 1.35: 0.92: 0.84: 0.96: 1.02: 1.72: 7: 84: 1.64: 1.12: 1.05: 1.20: 1.26: 2.01: 8: 96: 1.86 Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors US2Y: U.S. 2 Year Treasury - Stock Price, Quote and News - CNBC KEY STATS Yield Open 4.252% Yield Day High 4.351% Yield Day Low 4.241% Yield Prev Close 4.214% Price 98.0156 Price Change -0.2148 Price Change % -0.2188% Price Prev Close 98.2305 Price Day High...

United States Rates & Bonds - Bloomberg 9/23/2022. GB6:GOV. 6 Month. 0.00. 3.74. 3.86%. +65. +382. 9/23/2022. US Treasury Bonds - Fidelity US Treasury bills: $1,000: Discount: 4-, 8-, 13-, 26-, and 52-week: Interest and principal paid at maturity: US Treasury notes: $1,000: Coupon: 2-, 3-, 5-, 7-, and 10-year: Interest paid semi-annually, principal at maturity: US Treasury bonds: $1,000: Coupon: 20-year 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) United States Government Bonds - Yields Curve Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 21.50 and implied probability of default is 0.36%. Stocks, bonds rally after Bank of England says it will buy UK debt The yield on the benchmark 10-year US Treasury bond briefly topped 4% Wednesday before pulling back. It was the first time the yield moved above the 4% threshold since April 2010 and the highest ...

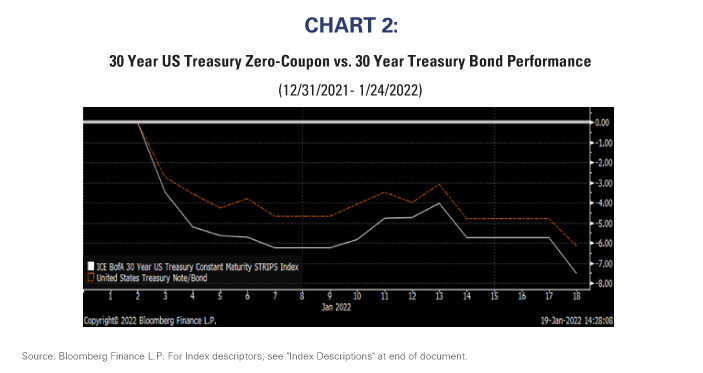

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Price Day Low 84.125 Coupon 3.00% Maturity 2052-08-15 Latest On U.S. 30 Year Treasury INVESTING CLUB We think the short end of the yield curve is very interesting right now, says BondBloxx's... Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Treasury Return Calculator, With Coupon Reinvestment Investing September 24th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. How To Buy Treasury Bonds And Buying Strategies To Consider Treasury bonds are issued by the United States federal government to finance projects or day-to-day operations. ... The buyer today of this 5-year treasury bond that expires on 06/30/2023 gets a 2.625% semi-annual coupon payment. Because interest rates have risen, the buyer can buy the bond below par value (below $100) compared to when the bond ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent...

US Treasury Zero-Coupon Yield Curve - NASDAQ Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

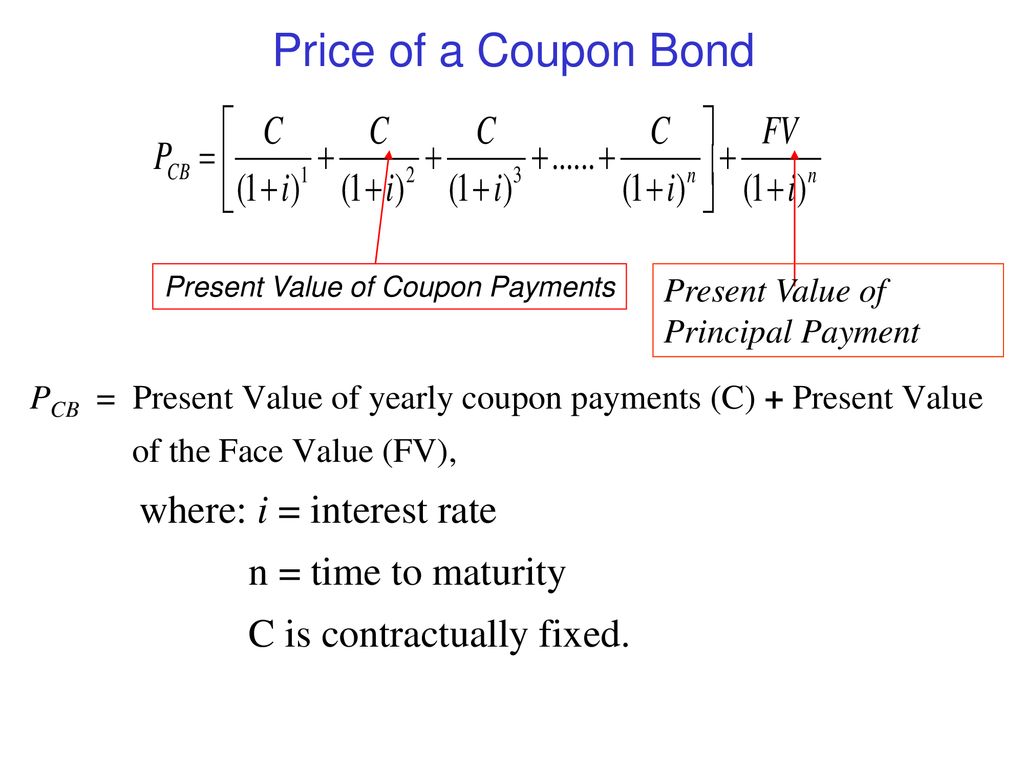

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the yields...

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Overview Charts Historical Quotes Key Data Open 4.147% Day Range 3.930 - 4.157 52 Week Range -0.376 - 4.215 Price 3 30/32 Change 0/32 Change Percent -0.06% Coupon Rate 0.000% Maturity Sep 7, 2023...

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon.. Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

How does the U.S. Treasury decide what coupon rate to offer on Treasury ... The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium.

10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.69%, compared to 3.70% the previous market day and 1.41% last year. This is lower than the long term average of 4.26%. Report. Daily Treasury Yield Curve Rates. Category. Interest Rates.

U.S. Treasury Bond Futures Quotes - CME Group Discover a streamlined approach to trading interest rate markets with Micro Treasury Yield futures, contracts based directly on yields of the most recently auctioned Treasury securities at key tenor points across the curve. ... volatility, auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings for EFFR and SOFR ...

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

What Is a Treasury Note? How Treasury Notes Work for Beginners What Do Treasury Notes Pay? Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields Treasury bonds, bills, and notes will all have varying yields. Longer-term Treasury securities typically yield higher returns than shorter-term Treasury securities.

Individual - Treasury Bonds: Rates & Terms Interest Coupon Rate Price Explanation; Discount (price below par) 30-year bond Issue Date: 8/15/2005: 4.35%: 4.25%: 98.333317: Below par price required to equate to 4.35% yield: Premium (price above par) 30-year bond reopening Issue Date: 9/15/2005: 3.99%: 4.25%: 104.511963: Above par price required to equate to 3.99% yield

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 us treasury coupon rate"